Economic feasibility

I

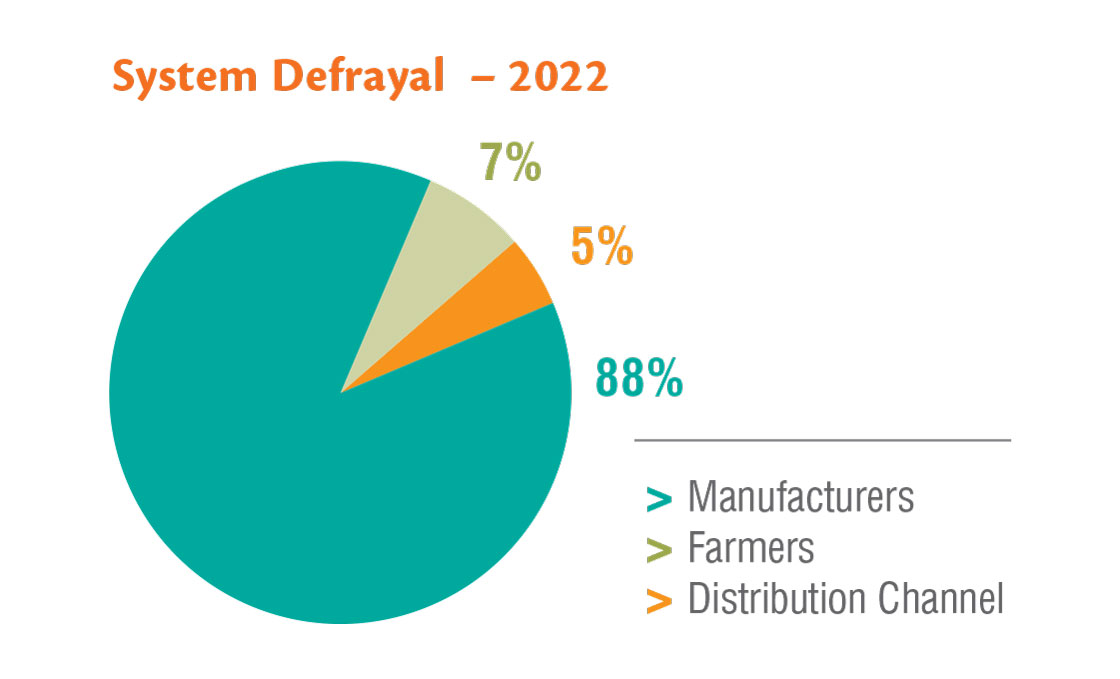

npEV continued with the array of initiatives to increase revenues and decrease costs of the Campo Limpo System, which addresses the strategic objective of achieving the System's self-sufficiency. Along the year, self-financing corresponded to 76%.

With these actions, the reduction goal for financial contributions established for 2022 was exceeded by almost R$ 6 million. This was the second consecutive year in which the initially defined value was surpassed and, for 2023, an even more ambitious goal has been set.

Among the efficiency initiatives, flexible packaging recycling, which will start operating in 2023, should represent an annual cost reduction with incineration of around R$ 15 million.

+ R$ 1.8 billion

contributed by all links of the chain to defray the Campo Limpo System since 2002.

ECONOMIC-FINANCIAL PERFORMANCE1 (R$ million)

2020

2021

2022

Total asset

165.3

174.2

185.4

Total resources (inpEV + chain links) that defray the program – accumulated since 2002

1.399,0

1.696,6

1.821,1

Net revenue of the activities

146.0

156.5

199.1

Member contributions

69.2

56.4

45.4

Campo Limpo Property Lease2

11.2

16.8

23.3

Net equity

112.4

89.9

105.1

Net Indebtedness3

2.6

5.6

7.1

1 Since 2021, the accreditation fee, paid by recyclers to receive packaging shipped by inpEV and for technical cooperation with the Institute, has been considered as part of the consultancy revenue, which also includes the inpEV and the partnering central stations' defrayal fees. In 2022, the consultancy revenues corresponded to R$ 94.3 million (in 2021, the value was of R$ 79.2 million).

2 Rent paid by Campo Limpo Plastic Transformation and Recycling S.A. to inpEV.

3 Only considers obligations with suppliers, excluding obligations with central stations and outposts.